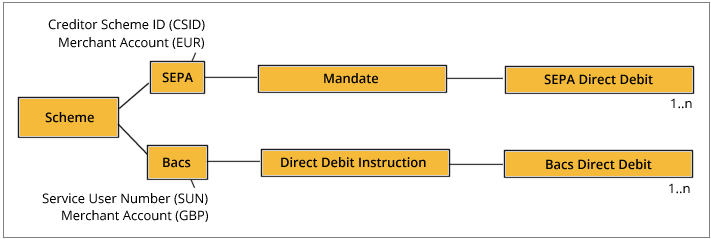

APIs must be called in a logical order: you must have a Creditor Scheme ID (in SEPA) or a Service User Number (in Bacs) before you create a mandate/DDI. You cannot create a payment without first creating a mandate/DDI.

When working with the Nuapay API you need to be aware that the sequence of requests is important.

- You cannot create a Direct Debit payment without first having created a mandate/DDI with which to link it.

- You cannot create a mandate/DDI without first having been assigned a Creditor Scheme ID (in SEPA) or a Service User Number (in Bacs).

- A Nuapay merchant account must also be linked to the scheme.

A signed mandate/DDI, which is in ACTIVE status (see Mandate Statuses for more on statuses), can be used to collect one or multiple Direct Debit transactions.

The following gives you a high-level view of the required stages:

- Before you can create mandates you must have a

Creditor Scheme Identifierand a Nuapay-issuedMerchant account. Nuapay Support will provide you with these details for both the Sandbox and Production environments. - With your Nuapay account and Payment Scheme configured (this may be a Bacs or a SEPA scheme) you can begin to add new mandates/DDIs.

- Mandates/DDIs have specific statuses (a

PENDINGstatus, prior to signature for example). Your mandates/DDIs must be inACTIVEstatus before you can collect payments. - Payment requests must be created a number of days prior to the desired collection date. In general payments may be created 2 business days before the desired collection date.

- As payments can fail for various reasons (insufficient funds in your payer’s account or a disputed transaction, for example) from the time when the payment is first created up to a number of weeks after the payment, it is important to ensure that you account for any failed payments and design how your solution will handle these.

Integration Models

Nuapay allows for two integration methods:

| Merchant | With this approach, you access the required API services for your business; you are acting as a single entity. |

| Partner | In this model you are acting on behalf of merchants, which exist under your partner-level entity. The partner needs to retrieve an OAuth tokens, which represents a specific “child” merchant, and then call the required APIs on behalf of that merchant, using that token. |

For more on the the Merchant and Partner integrations, see the Integration Overview section.