Merchants and Partners may combine Open Banking with Direct Debit electronic mandates (E-Mandates) to manage subscription payments.

| Depending on your business requirements, you may offer either Open Banking Payment initiation OR Open Banking Account Access to create an electronic mandate to allow you to collect payments via Direct Debit. |

Nuapay Open Banking & E-Mandates support both the Bacs Direct Debit scheme (GBP) and also the SEPA scheme (EUR).

Note that:

- For

CHECKOUTandREDIRECTintegrations, some client-side JavaScript is required to launch this flow. - For

SELF-HOSTEDintegrations, a Postman collection is available.

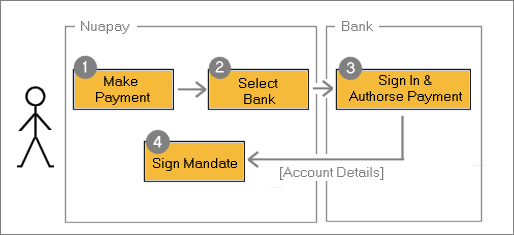

Payment Initiation and E-Mandates

In the Payment-based flow:

- The merchant creates a payment request initially (this might be a penny payment or it could be the first payment in a schedule).

- The PSU selects a bank on the Nuapay TPP.

- He/she is redirected, logs on, and authorizes the payment at the selected bank.

-

The user is then passed back to the Nuapay TPP with the account details, which were used to make the payment, pre-filled on the Direct Debit signup page. Once the user reviews and confirms the mandate details, the merchant may arrange to collect future payments via Direct Debit.

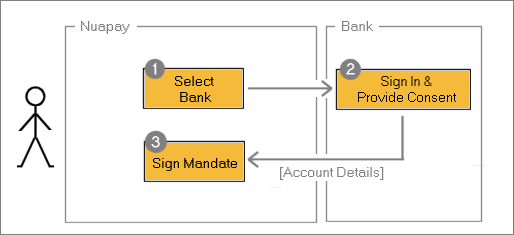

Account Access and E-Mandates

In the Account-Access-based flow, the user gives consent to use an account for the E-Mandate setup:

- The user is prompted to select a bank.

- Once redirected to the bank, the user logs on, and selects the bank account to use for the mandate setup.

-

The user is redirected back to the Nuapay TPP, to the Direct Debit Signup page, with the selected account’s information pre-filled. Once the user confirms the mandate details, the merchant may then collect future payments via Direct Debit.

Benefits for Merchants

For Merchants: Combining the Open Banking and Direct Debit signup is an attractive option because:

In the Payment Flow:

- Merchant can take a first payment and sign up the PSU for additional payments in one step.

- The PSU initially makes a payment through Open Banking; that first payment is collected immediately. As this is a bank transfer payment, there is no risk of a refund/chargeback.

In the Payment Flow and the Account-Access flow:

- The retrieved bank details are used to pre-populate the Electronic Mandate (E-Mandate) signup page, simplifying the signup for the PSU, meaning that drop-offs are reduced (PSUs do not need to manually type account details).

- Because account details have been retrieved from the user’s bank (following the PSU completing Strong Customer Authentication at the bank) you can be confident that the payer is the account owner, massively reducing (if not fully eliminating) the fraud risk.

- Once the mandate is signed, future payments may be collected via Direct Debit, which is a pull payment method: merchants can set up a schedule and “pull” funds from their payers’ accounts at regular intervals for subscription billing. The merchant is not relying on the payer to “push” payments.

Benefits for Users

For Users:

- Setting up a bank transfer payment and Direct Debit payments is all handled in a single interaction with the merchant.

- Account details are automatically populated on the Direct Debit Signup screen so there is no need to find account details or to key them in.

- For EUR payments in particular, having to key in an IBAN can be tedious, which can result in drop offs.

- In the payment flow, as the first payment is made initially, the user can receive the merchant’s service right away; there is no need to wait for a payment schedule to be created or a mandate to be activated.

- As in the standard Open Banking payment flow, users can scan a QR code to complete the flow on a mobile device, again simplifying the overall signup process.