Bank Transfer transactions transition through various payment statuses and in some cases a payment may move to a status from which users are unable to complete their payment. This may happen, for example, where users:

- Discover that they have insufficient funds on a specific account (and want to choose an account that’s held in another bank).

- Lose their Internet connection before approving the payment.

- Have a mobile device that runs out of battery during the payment.

- Etc.

In these cases it is possible to retry the payment, provided:

- The retry is attempted before the payment’s timeout period is exceeded.

- The payment is in an appropriate status, which allows for a retry.

Retries are possible for payments that are in specific statuses, as summarised in the table below:

| Payment Status | Can be Retried? |

PENDING |

Yes |

PENDING_APPROVAL |

Yes |

DECLINED |

Yes |

SETTLEMENT_REJECTED |

Yes |

CONSENT_API_REJECTED |

Yes |

UNEXPECTED_ERROR |

Yes |

UNKNOWN |

No |

SETTLEMENT_COMPLETE |

No |

PAYMENT_RECEIVED |

No |

TIMEOUT |

No |

AUTHORISED |

No |

SETTLEMENT_PENDING |

No |

SETTLEMENT_IN_PROGRESS |

No |

OAUTH_CALLBACK_COMPLETE |

No |

CONSENT_TIMEOUT |

No |

For more information on these payment statuses, see Payment Statuses.

Configuring the Retry Functionality

Some clients find the default retry behaviour problematic. Webhooks notify clients about changes in payment status; when a failed payment is automatically retried, it can trigger a sequence of webhook events—such as PaymentRejected followed by PaymentCompleted. This can be unexpected for some clients, who may prefer to handle retries themselves by starting a brand new payment process.

If you’d prefer not to allow customers to retry failed payments, you can turn off this feature in the Nuapay Console:

- Log in to the Nuapay Console.

- Go to Products > Open Banking PIS.

- Clear the Allow Failed Payments Retry option.

Please note:

- This setting is enabled by default (true), which means failed payments can be retried unless you change it.

- If you disable retries, the Retry Payment option will no longer be visible to end users (PSUs) once a payment reaches a final status.

CHECKOUT & REDIRECT Integrations

The PSU interaction is similar for both the CHECKOUT and REDIRECT integrations, where a payment retry is possible.

To illustrate the end user’s experience, take the following example:

- The PSU selects to pay via Bank Transfer.

- The user selects a bank and is redirected.

- When reviewing the payment, the PSU decides to cancel before authorising the payment (he/she realises that there are insufficient funds on the account for example).

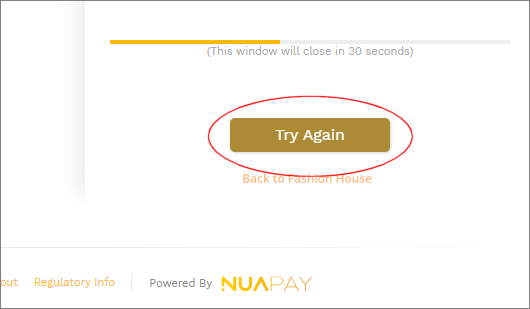

- The PSU is redirected to the Nuapay TPP Fail/Cancel screen, with an option to try again:

- Once the user clicks Try Again, he/she is redirected to the Bank Selection screen (allowing the user to select another bank).

SELF-HOSTED Integrations

For SELF-HOSTED and SELF-HOSTED-CALLBACK integrations, merchants/partners will need to programmatically design how they want retries to be handled.

To manage a retry for a given paymentId:

- Call the Retry Payment API (Retry Payment).

- Pass the

paymentIdof the payment that will be retried. - The

bankIdis also required - this will be the ASPSP at which the PSU will approve the retried payment.

See Retry Payment for more details on this service.